Perth Tower Cranes Economic Indicator!

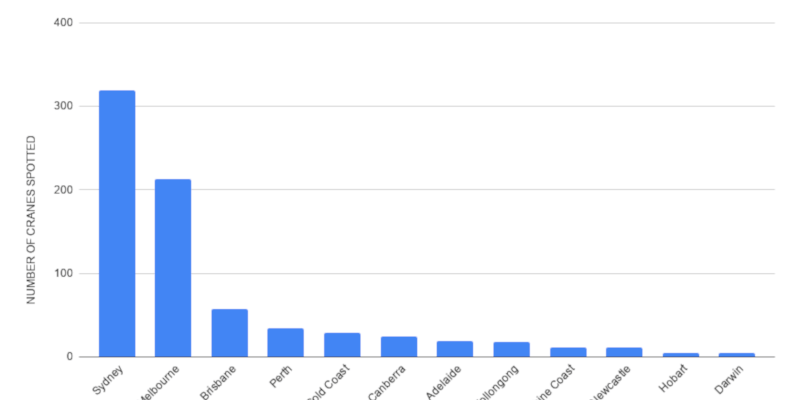

The spotting of tower cranes in the Perth city skyline has often been an economic indicator of the Western Australian economy. The chart above shows the number of tower cranes in a full year in Australian cities.

34 tower cranes were spotted on Perth building construction sites in 2020. More would have been spotted on Western Australian resource industry construction sites.

Mobile Tower Crane Hire Perth

Civil engineers and building construction engineers in Perth know when it’s best to hire tower cranes in Perth but there are times to consider alternative mobile crane hiring in Perth. We have 100t cranes with boom extensions for very tall reach. In 2020 we’ll be getting a 250t mobile construction crane for hire in Perth with and extra high crane boom.

Perth Crane Hire Considerations

With a growing number of mobile crane companies investing in more and bigger mobile cranes for hire in Perth, crunching the numbers for the best crane hire value and performance needs consideration. Advantages of mobile crane hire in Perth are listed below:

- The big advantage of mobile cranes over tower cranes is the speed of deployment. With building construction project speeding up, mobile cranes should be considered for hire.

- Mobile crane technology is improving all the time. With extra reach and load capabilities, mobile crane rental in Perth is becoming a viable alternative to tower crane hire.

- Ashburton Crane Hire can hotshot a mobile crane quick from Perth to your mine site or other resources project in Western Australia. We also have a supporting WA transport service to provide an integrated logistics service.

HIRE MOBILE CRANES TO ASSEMBLE TOWER CRANES IN PERTH

If you still need tower crane hire in Perth, know:

- We can recommend reliable, safe tower crane companies in Perth WA.

- Our mobile cranes are hired to assemble tower cranes in Perth.